Competitive Rates

Using Metric’s partnership leverage

Smooth Customer Set-up

Easy On-boarding process

High Standards of Security

PCI DSS Compliant

Card Payment Services

Trusted Distributor of the PSP Service

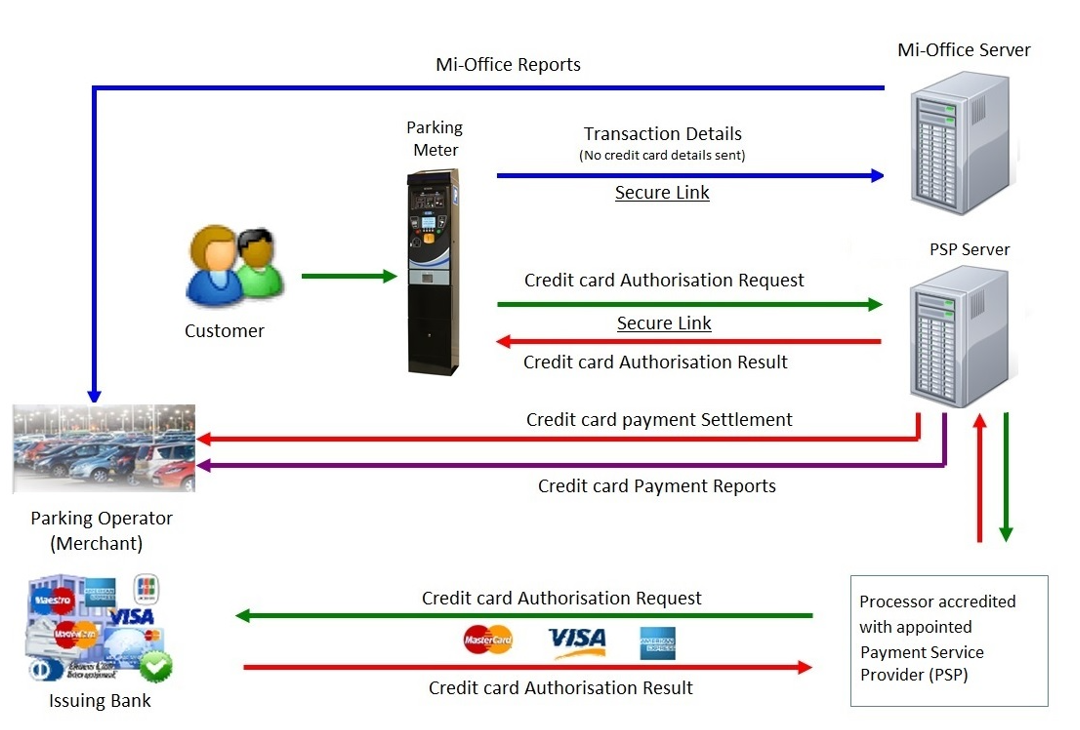

A payment service provider (PSP) connects merchants (car park owners) to the broader financial system so they can accept and process credit/debit card payments from end users who wish to pay for a parking session.

The payment services industry is highly controlled and regulated and only approved and accredited suppliers are allowed to call themselves a PSP

In keeping with this, Metric have partnered with NMI – who are a leading payment enablement platform. This allows us to provide a secure, safe and seamless service for cashless transactions alongside a qualified, regulated and approved PSP.

This partnership empowers Metric as a trusted distributor of the payment services provided in collaboration with NMI

Process flow explained for a cashless parking transaction.

Step-by-step guide to setting-up Payment Services

Step 1

Step 2

Step 3

Step 4

Step 5

Contractual obligations are verified with Metric for PSP & Merchant Acquirer set-up

Customer to apply for Merchant Account following KYC & AML procedures

Once Merchant Account is set up, customer to provide Merchant ID to Metric for onboarding

Onboarding registration forms completed & processed

Customer is ready to accept Card Payments

Web Portal (WebMIS)

The web portal is an online reporting tool which allows customers to drill down through transaction data.

The portal has an easy-to-use integration tool which provides various types of information on cashless transactions. Once logged on users can report data by terminal, card type and date. These reports are easily exported into Excel and other file formats.

You will receive your user account(s) details once the onboarding process has been completed.

Refunds can also be submitted through the Web Portal, even without the full card number, using each transaction’s unique reference number. Refund security is excellent, automatically preventing refunds of a higher value than the original transaction and thereby minimising fraud opportunity.

User training will be provided once live data is available and transactions have been handled.

Frequently Asked Questions

Why do we need a Payment Service Provider, why can’t we just use Worldpay or our current merchant acquirer?

Each payment terminal needs to not only be integrated with the supporting parking hardware but must be certified with the card schemes via merchant acquirers. These certifications are expensive and time consuming sometimes up to 12 months.

![]()

Yes, all solutions regardless of merchant acquirer utilize the contactless reader to accept mobile payments. Applepay, Androidpay and Googlepay are all supported.![]()

All debit and credit cards issued by Mastercard and Visa are accepted. Amex is currently not supported with the Verifone UX hardware range

![]()

Funds on the terminal are generally settled each night and sent to the merchant acquirer. The merchant acquirer is responsible for settling the funds into the merchant’s bank account, usually within 2 days except for weekends. These questions should generally be directed to the acquirer i.e., Worldpay and/or Globalpayments.

Terms and Conditions

Click HereOur Sales Team

David Spurr

Head of Payment Services and Innovation

Follow Us on LinkedIn

If you want to stay up to date with the news and views of Metric Group, and be the first to hear about website updates, product launches, exhibitions and more, we invite you to follow our LinkedIn page. Simply click on the button below, LinkedIn will open in a new tab, and then click the follow button.